The 'Shroom:Issue 168/64 Wars: A Battle for Sales

It was the middle of the 1990’s. Nintendo was soon to release their next video game console, the N64. For years, Nintendo had been a dominant force in the industry. The last generation had seen fierce competition between Nintendo’s Super Nintendo Entertainment System and Sega’s Genesis, but Nintendo had managed to maintain a large piece of the market despite Sega’s success.[1] Now both companies were preparing to release new consoles and begin the industry’s leap into 3D graphics. At the same time, a new competitor was also preparing to enter the console market. Sony was developing their first console, which would eventually come to be known as the Playstation. The Playstation was eventually released to the U.S. in September 1995 with the Nintendo 64 following in September 1996.[1] With Nintendo’s extensive experience in making consoles compared to Sony’s new entrance to the market, one might expect that Nintendo would maintain their hold on the industry, making it challenging for Sony to gain control. However, this is not the situation we find if we examine the scene several years later at the turn of the century. Here we find Sony’s Playstation dominating the market, with the Nintendo 64 holding a distant second place and Sega’s Saturn even further behind. By 2002, the Playstation had sold over 89 million units worldwide while the N64 had only sold about 32 million units.[2][3] Clearly, there had to be reasons for this huge shift in control.

To determine the reasons for the shift in control, one must investigate how Sony became so dominant in the industry over Nintendo. This can be accomplished by examining the different factors that led to the rise of Sony and the downfall of Nintendo. By comparing Sony’s decisions and strategies to Nintendo’s equivalent choices, one can determine what good decisions by Sony and bad decisions by Nintendo led to the shift in industry control. These factors include technological factors such as Sony’s use of CD-ROMs versus Nintendo’s use of cartridges, the importance of establishing an install base of console owners early on, the number of games for a platform, console pricing, and the number of third-party developers for a console. Discussion of the background of previous console generations as well as the aftermath in the following generation will also be helpful in seeing the causes and effects of the fifth console generation. By examining the many factors that led to Sony’s dominance and Nintendo’s comparative failure, it becomes apparent that the shift in market control was caused by a failure on Nintendo’s part to properly engage the market with effective strategies and policies in several aforementioned areas as well as Sony’s concurrent decisions that proved effective in these areas.

Technology often plays a role in the success of video game consoles and the fifth generation is no exception. Sony’s use of CD-ROMs versus Nintendo’s use of cartridges is widely considered to be an important factor in the console competition of the fifth generation. It is often believed that Nintendo’s use of cartridges left them at a major disadvantage compared to the newer technology of Sony’s CD-ROMs, but looking at the data suggests that it may not have been as detrimental to their success as commonly claimed. However, Sony did receive advantages from a CD-ROM format that Nintendo would not be able to enjoy with cartridges. Although producing the hardware required to read CD-ROMs was more expensive than cartridge-based consoles, producing the CD-ROMs themselves was cheaper than producing cartridges, thereby enabling cheaper mass production of game discs.[4] Furthermore, low prices of production meant that games could be priced lower and therefore sell more copies, making the CD-ROM format attractive to third-party game developers.[4] In addition to these advantages, CD-ROMs had more storage space than cartridges, an advantage that many scholars believe played a major role in Sony’s victory over Nintendo due to third-party developers opting to develop for the console that allowed them to make bigger games.[5] Clearly, Sony’s use of CD-ROMs had many benefits.

However, cartridges were not without their advantages to Nintendo. As previously stated, the cartridge-reading consoles were cheaper than to produce than CD-ROM readers. Cartridges were also capable of faster loading times than CD-ROMs, an advantage often emphasized by Nintendo as a benefit for consumers.[1] Additionally, Nintendo had more experience with the cartridge format, thereby making it simpler and cheaper to stick with it compared to switching to the new CD-ROM format.[4] Despite these advantages, CD-ROMs still appear to have had more advantages overall, which is likely why many believe the use of cartridges was detrimental to Nintendo. Even so, not all scholars agree with this. Using marketing simulations as evidence, Hongju Liu claims that “Nintendo would have been strictly worse off by choosing the CD-ROM format unless the number of N64 games increased by more than 40% (as a result of switching to CD-ROM)”.[4] Therefore, while it is safe to surmise that using the CD-ROM format was the most beneficial decision for Sony, it is not clear that Nintendo would have benefited from doing the same. Sony’s technological advantages with CD-ROMs would have been difficult to counter whether Nintendo had used cartridges or CD-ROMS. One can then conclude that using CD-ROMs was the right decision for Sony, but using cartridges was not a mistake for Nintendo, or at least not a major one.

Another factor that often plays heavily into the success of a console is the establishment of an install base of consumers who own the console early in the console’s life. This factor played a large role in the fifth console generation due to strategic decisions by Sony and less effective decisions by Nintendo. In her article on the U.S. console industry, Melissa A. Schilling lists acquiring a large install base as one of the key aspects of a successful console due to the consumer benefits gained by having a network of users.[1] A very effective way for a company to establish an install base is by releasing their console before the competition as this will allow them to get a head start on gaining a userbase and a catalogue of games. In fact, this is exactly what Sony did in the fifth generation.[4] As mentioned previously, Sony’s Playstation launched in the U.S. in September 1995, a whole year before the launch of the Nintendo 64 in September 1996. By the end of 1996, the Playstation had sold 2.9 million units in the U.S.[1] This head start was very beneficial to Sony as it allowed them to gain an install base before Nintendo had even released their console. Due to the interconnectedness of many of the factors in video game sales, this also led to more third-party development for the console, which led to more games being produced and even more consumers purchasing the console.[1] Furthermore, through policy simulations, Liu predicts that Sony would have suffered a loss in profits greater than Nintendo’s actual loss if Nintendo had gained a head start over them. He surmises from this that having a head start was especially important to Sony and that this may be due to “a higher intrinsic preference for the N64”.[4] This further highlights the fact that releasing their console first was very helpful in gaining an install base and maintaining a lead even after the N64’s release.

While Sony benefited greatly from the Playstation’s earlier release, the N64 was significantly set back by its late entrance to the market. With Sony’s head start to the market, Nintendo started with a disadvantage that contributed to their failure in surpassing Sony. However, this was not the only time that Nintendo was disadvantaged by entering the market later than their opponent. In the previous generation, Nintendo had released their Super Nintendo Entertainment System a full two years after Sega’s Genesis, which helped Sega gain an advantage in the first few years of the generation.[1] Furthermore, Nintendo released their Gamecube console a year after Sony’s Playstation 2 in the sixth generation, during which Nintendo suffered an even bigger sales gap compared to Sony.[4] Clearly, this was a trend in Nintendo’s behavior over the years, though they did have certain motivations for delaying new console releases. Liu speculates that Nintendo may have waited to release the N64 in order to continue collecting revenue from their previous console, the Super Nintendo Entertainment System.[4] Other scholars have corroborated this claim, stating that the SNES “continued to outsell the more advanced fifth-generation consoles until Christmas 1996”.[5] Still, this strategy appears to have mostly hindered them in the end due to its effects on the N64’s success. Liu claims from his policy simulation that “[g]iven a head start of one million units … Nintendo could have won the console war”.[4] Therefore, it is clear that Nintendo made a mistake in not releasing their console earlier, while Sony’s strategy yet again proved to be the most successful as it enabled the Playstation to have an early install base and thereby have a head start in growing their user base and library of games.

When considering video game consoles from a consumer perspective, it is apparent that the number of games for a console would have a large effect on the sales of the platform. Consumers prefer a console that has a large selection and variety of games. Therefore, it is important for a console to start amassing a large amount of games early on. In their article on the marketing effects in the 32-/64-bit video game console market, Pradeep K. Chintagunta and his co-authors list the number of games for a console as an important driver of sales, noting that it is especially important to focus on generating games later in a console’s life.[6] In the fifth console generation, Sony succeeded in having a large variety of games while Nintendo had difficulty in having a steady stream of releases for its console. The Playstation had fifty titles released by the end of its launch year and eight hundred by the end of 2000.[1] On the other hand, Nintendo had only six titles released by the end of its launch year and two hundred ninety-six titles in the U.S. by May 2002.[1][3] This large gap between the number of games for Playstation and for N64 is indicative of major differences in policy between the two companies. For their part, Sony instituted policies that had the goal of attracting as many third-party game developers as possible, a decision which proved to be a major factor in their success.[4] One of these policies was the strategy of making software exclusivity deals with third-party developers. Before the Playstation’s launch, Sony signed agreements with Electronic Arts and many other major third-party game developers that would require them to produce titles exclusively for the Playstation for six months after the console’s launch.[1] This enabled Sony to bolster their game library early on while also limiting the competition’s options for game releases. Strategies such as these enabled Sony to continue having games released frequently for their console throughout its lifespan, giving them an advantage in consumers’ eyes that Nintendo was not able to keep up with.

Though Sony made it difficult for Nintendo to secure a large number of game titles, Nintendo failed to change certain policies that were advantageous in past generations but were no longer viable in the current market. This led to a library that had strong first-party support from Nintendo’s in-house developers but little support from outside third-party developers. Nintendo’s successful first-party offerings were their most popular titles and they contributed the most to the system’s sales, as is evidenced by the fact that despite there being “only two software titles available at the console’s release (one being Super Mario), the game units were sold out within weeks of their release”.[1] Even so, the lack of third-party support on the console limited the number of games available for consumers. This lack of third-party games was due in large part to Nintendo’s strict licensing policies that were seen by third-party developers as less attractive than Sony’s more lenient policies. These policies included requiring third-party developers to pay high royalties to release games on their console as well as having strict quality control.[4] Though it may seem strange for Nintendo to hold such strict policies for third-party developers when faced with Sony’s opposition, Nintendo had good reason to institute these policies in previous generations. As Schilling discusses, Nintendo had introduced their first console to the U.S. to great success two generations prior, reviving a console industry that had nearly died out due in part to a severe lack of quality control on consoles such as the Atari 2600. Without competition as the only major console maker of that generation, charging high royalty fees was a profitable policy and strict quality control was essential to avoiding the mistakes of past console makers.[1] However, these formerly beneficial policies became disadvantageous in later generations as other console makers entered the competition with much more lenient licensing policies. In the next generation, Sega’s lenient policies made it difficult for Nintendo to keep all the developers that had previously made games for their console, a trend that then increased dramatically due to Sony in the fifth generation.[1] The subsequent loss of games due to these policies can be seen from Liu’s policy simulations, where it is estimated that Nintendo could have become the market leader with a ten percent increase in number of games available.[4] It is then clear that Nintendo missed an opportunity to acquire more games for the N64 and possibly even win the console war by not changing their outdated policies.

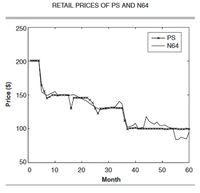

Another factor that affects game console sales is the pricing of the consoles. In an industry that sells relatively expensive technology, pricing competitively and strategically is essential, a fact that both Nintendo and Sony were aware of. Chintagunta and his co-authors list prices as an important factor in the sales of a console, emphasizing it as especially important early in the console’s life and recommending aggressive pricing during these stages.[6] However, this is not the only possible strategy for a game console’s pricing. Liu discusses two different strategies of console pricing, which are penetration pricing and price skimming. Penetration pricing involves setting a low price for a product right away in order to penetrate the market quickly while price skimming advocates initially pricing a product high and lowering the price over time in order to capture dedicated buyers early on before moving to the casual buyers. He also notes that the price of the Playstation dropped over time, which seems to resemble price skimming.[4] Meanwhile, Nintendo initially launched their console with a low price of $199, which is more consistent with penetration pricing.[1] Both strategies seem to be valid, making it not immediately clear which would produce an advantage.

However, Sony’s pricing strategy appears to have been more complex than just using price skimming. In a move reminiscent of penetration pricing, Sony launched the Playstation at the price of $299, a competitive price which was $100 lower than the launch price of its main opponent at the time, the Sega Saturn.[1] Furthermore, Liu notes that the Playstation console sales actually incurred losses initially with profits rising over time despite the lower pricing, an effect that he attributes to the production costs of the console lowering drastically with time.[4] This combined with the aforementioned low production costs of CD-ROMs indicates that Sony’s pricing strategy was a multifaceted approach that took advantage of competitive pricing at launch, lowering prices over time, lowering production costs, and abundant low-cost production of games to allow them to primarily receive profits from game sales at first before eventually making profits off of console sales. This plan proved rather effective as it allowed them to take all the factors of the video game market into account while playing to their other strengths such as their third-party deals. While Nintendo’s low pricing strategy was not a bad plan, Sony’s more complex strategy allowed them to enter the market with more force and maintain a strong position thereafter.

The final factor to consider is the influence of third-party game developers. Although some games can be produced by console manufacturers themselves, a console needs to attract other game companies and make them want to produce games for it. Because of this, the third-party development factor is heavily reliant on the other factors of a console’s success. At the same time, it heavily affects some of the other factors, with number of games understandably being the most prominent. Despite the fact that much about third-party developers has already been discussed because of this interdependence, it is useful to examine the situation from the perspective of third-party developers to understand their effect more fully. To a prospective third-party developer, there were three major advantages to developing for Sony instead of Nintendo: the greater storage and cheaper production costs of CD-ROMs compared to cartridges, the more friendly licensing policies, and Sony’s head start that provided an already growing userbase. Meanwhile, the advantages of developing for Nintendo over Sony mostly amounted to their formidable name-brand recognition to consumers and the higher processing power of the 64-bit N64 over the 32-bit Playstation.[4] Furthermore, the higher production cost of cartridges combined with Nintendo’s high licensing fees led to lower overall profits for third-party developers despite N64 games being sold for about $20 more than Playstation games.[4] This combined with Sony’s already growing userbase of potential buyers caused many third-party developers to choose the Playstation over the N64 once both consoles were released. Once Sony had used their format’s advantages and their licensing and pricing policies to start gaining third-party support, a large library of games, and a large userbase, they were able to continue building this momentum, leaving Nintendo unable to catch up and eventually dethroning Nintendo as the leader of the video game console market.

An examination of the battle for dominance between Nintendo and Sony in the fifth video game console generation would not be complete without some discussion of the aftermath of the generation to determine what the two companies learned from the struggle. With the turn of the century, the Playstation and N64 were succeeded by Sony’s Playstation 2 and the Nintendo Gamecube as part of the sixth console generation. With the experience gained from the massive success of the Playstation, Sony went on to enjoy even greater success with the Playstation 2. The Playstation 2 sold over 1 million units in its opening week and Sony owned 70% of the market share by the end of the console’s life.[1][5] It is evident that Sony used similar strategies in the release of the Playstation 2 as they had used in the fifth generation. For example, Sony once again received a head start on their competition as they released Playstation 2 in the U.S. in March 2000, nearly two years before the release of the Gamecube in November 2001.[1] Amid the Playstation 2’s success, Nintendo continued to be an underdog in the home console industry. Nintendo did change some of their policies in this generation, such as abandoning the cartridge format and switching to a DVD-ROM format for the Gamecube due to the cheaper price of the DVD format as well as the format’s greater anti-piracy capabilities.[7] However, Nintendo still struggled with gaining third-party support and were unable to reclaim their position as a market leader until the massive success of their Wii console in 2006.[5] Today, both Sony and Nintendo continue to be major brands in the video game industry whose consoles elicit much discussion and admiration from critics and fans alike.

In conclusion, the victory of Sony over Nintendo in the fifth console generation was caused by good decisions by Sony as well as less effective decisions by Nintendo in the areas of technological format, install base growth, number of games, pricing, and relations with third party developers. The successes and mistakes of the fifth console generation provide useful lessons for modern console makers about which decisions will lead to success and which will lead to failure. A console maker should pay heed to technology by choosing hardware that will be appealing to both consumers and third-party developers. They should do all they can to increase their install base through methods such as the hitting the market before their opponents. Additionally, they should develop strategic pricing plans that take best advantage of the market climate and formulate agreeable business policies that will attract third-party developers and subsequently increase their game library. These guidelines can help produce consoles that are better for the developers, the consumers, and the industry as a whole. Many scholars have come to similar conclusions based on the outcome of the fifth generation as well as other generations.[1][5] However, in the end, financial success and market share are not the ultimate goals a game console developer should strive for. The true mark of a great video game console is that it provides memorable and joyful experiences to its players. Despite its failures on the market, the Nintendo 64 maintains a legacy as one of the most fondly remembered consoles of all time in the hearts of many. The original Playstation has a similar legacy that endures to this day. Indeed, the fond memories made from both consoles continue to endure long after the last dollar of their profits have been spent.

References

- ^ a b c d e f g h i j k l m n o p q r Schilling, Melissa A. “Technological Leapfrogging: LESSONS FROM THE U.S. VIDEO GAME CONSOLE INDUSTRY.” California Management Review, vol. 45, no. 3, Spring 2003, pp. 6–32. EBSCOhost, doi:10.2307/41166174, https://www.researchgate.net/public...ssons_from_the_US_Video_Game_Console_Industry. Accessed 27 Mar. 2020.

- ^ (Sony Computer Entertainment Inc. “PlayStation® Cumulative Production Shipments of Hardware.” Sony Computer Entertainment Inc., 2011, www.scei.co.jp/corporate/data/bizdataps_e.html. Internet Archive, http://web.archive.org/web/20110524023857/http://www.scei.co.jp/corporate/data/bizdataps_e.html. Accessed 27 Mar. 2020.

- ^ a b Nintendo Co., Ltd. “CONSOLIDATED FINANCIAL STATEMENTS.” Nintendo.co.jp, 30 May 2002, www.nintendo.co.jp/ir/pdf/2002/020530e.pdf. Accessed 27 Mar. 2020.

- ^ a b c d e f g h i j k l m n o p Liu, Hongju. “Dynamics of Pricing in the Video Game Console Market: Skimming or Penetration?” Journal of Marketing Research (JMR), vol. 47, no. 3, June 2010, pp. 428–443. EBSCOhost, doi:10.1509/jmkr.47.3.428, https://www.jstor.org/stable/25674441. Accessed 27 Mar. 2020.

- ^ a b c d e Subramanian, Annapoornima M., et al. “Capability Reconfiguration of Incumbent Firms: Nintendo in the Video Game Industry.” Technovation, vol. 31, no. 5-6, Elsevier Ltd, May 2011, pp. 228–39, doi:10.1016/j.technovation.2011.01.003, https://www.sciencedirect.com/science/article/abs/pii/S0166497211000137. Accessed 27 Mar. 2020.

- ^ a b Chintagunta, Pradeep K., et al. “Measuring Marketing-Mix Effects in the 32/64 Bit Video-Game Console Market.” Journal of Applied Econometrics, vol. 24, no. 3, 2009, pp. 421–445. JSTOR, www.jstor.org/stable/40206284. Accessed 27 Mar. 2020.

- ^ Manafy, Michelle. “Nintendo Joins Sony in Adopting DVD for Next Generation of Gaming Devices.” EMedia Professional, vol. 12, no. 7, Information Today, Inc., July 1999, p. 20., https://ww2.cdmediaworld.com/hardware/cdrom/news/9905/nintendo_sony_dvd.shtml. Accessed 27 Mar. 2020.

| The 'Shroom: Issue 168 | |

|---|---|

| Staff sections | Staff Notes • The 'Shroom Spotlight • 'Shroomfest |

| Features | Fake News • Fun Stuff • Palette Swap • Pipe Plaza • Critic Corner • Strategy Wing |

| Specials | Super Mario 3D World + Bowser's Fury Photo Contest • 64 Wars: A Battle for Sales |